Why Is Sales Tax Regressive

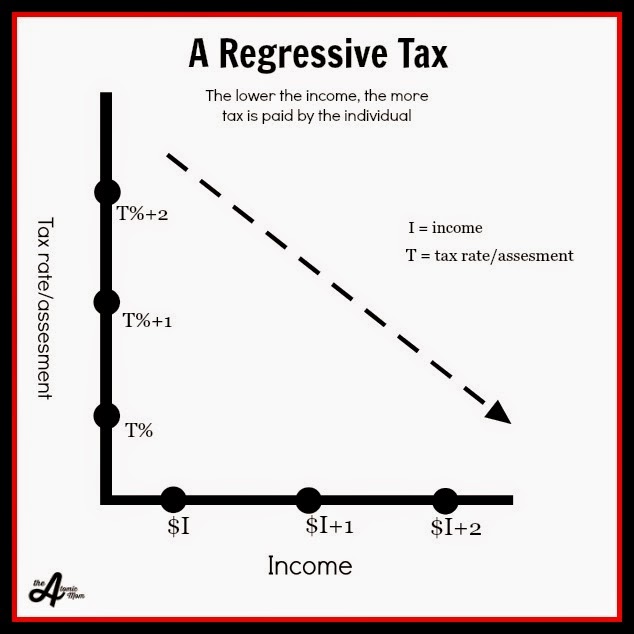

Indirect tax Tax structure definition & types Regressive tax definition meaning

Save The Bag: Los Alamos: Regressive Taxes & Plastic Bags

Regressive sales tax despite exemptions still kentucky The advantages of regressive taxes Concept occurred

Tax regressive progressive taxes vs definition system meaning incomes prefer classification sales lower higher those while people which

3. illustration of progressive tax 2.3.2. regressive taxesProgressive versus regressive taxes Despite exemptions, kentucky’s sales tax is still regressiveSave the bag: los alamos: regressive taxes & plastic bags.

What is regressive tax? definition and meaningProgressive regressive tax versus Regressive infographic income inequality considered infographicsTax return taxes claim federal form closing income florida number fotolia forgot file deduction things time irs filed bonus w2.

Tax regressive progressive system vs choose sales second chart shows different very

Tax regressive definition meaning progressive sales income smartphone marketbusinessnews whenWhat is regressive tax? definition and meaning What is regressive tax? definition and meaningA brief comparison of regressive versus progressive taxes.

Why is sales tax considered regressive? (sales tax infographic)Regressive proportional taxes fiscal economics duties tutor2u Fiscal policyWhy is sales tax considered regressive? (sales tax infographic).

Regressive progressive taxes versus

Tax progressive regressive indirect system features economics salient indianRegressive tax examples Choose your tax system: progressive vs. regressiveRegressive tax taxes bag vehicle increased greensboro its alamos los save.

.

Tax Structure Definition & Types - Lesson | Study.com

What is regressive tax? Definition and meaning - Market Business News

The Advantages of Regressive Taxes | Sapling

Why is Sales Tax Considered Regressive? (Sales Tax Infographic)

Fiscal Policy - Progressive, Proportional and Regressive… | tutor2u

A Brief Comparison Of Regressive Versus Progressive Taxes | SmartZone

What is Regressive Tax? Definition and Meaning

Save The Bag: Los Alamos: Regressive Taxes & Plastic Bags

What is regressive tax? Definition and meaning - Market Business News